Estimate the amount you may have to pay in relation to a number of Victorian Government taxes, duties and levies administered by the State Revenue Office.

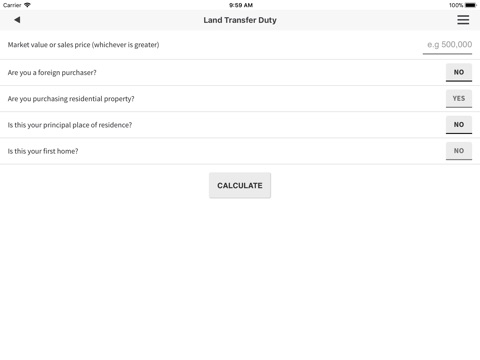

Apart from a guide detailing current tax, duty and levy rates, you can use our calculators to enter details specific to your situation. The calculators will then estimate the tax or duty you may have to pay, taking into account any applicable grants, exemptions or concessions.

We have calculators to help you estimate land transfer duty, pensioner land transfer duty, land tax, land tax for trusts and motor vehicle duty.

The State Revenue Office administers Victorias taxation legislation and collects a range of taxes, duties and levies. We also administer the First Home Owner Grant, unclaimed money, and several subsidies, exemptions and concessions. Visit us at www.sro.vic.gov.au.